Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

market analysis

【XM Decision Analysis】--EUR/USD Analysis: Stability After Upward Attempts

Risk Warning:

The purpose of information release is to warn investors of risks and does not constitute any investment advice. The relevant data and information are from third parties and are for reference only. Investors are requested to verify before use and assume all risks.

Hello everyone, today XM Forex will bring you "【XM Decision Analysis】--EUR/USD Analysis: Stability After Upward Attempts". I hope it will be helpful to you! The original content is as follows:

- For two consecutive days, the EUR/USD currency pair has resumed trading within the broader downward trend, stabilizing around the support level of 1.0452 at the time of writing this analysis.

- It has retreated from its recent gains that reached the resistance level of 1.0514, the highest for the currency pair in three weeks.

- Consequently, the downward movement will persist until there is a reaction to the announcement of the minutes of the US Federal Reserve meeting and the path of imposing US tariffs.

Why has the Euro declined again?

According to Forex trading and through licensed trading www.xmbonus.company platforms, the EUR/USD pair has returned to its downward path due to concerns about rising government spending and falling interest rates. French President Emmanuel Macron has invited regional leaders, including Olaf Scholz of Germany and Giorgia Meloni of Italy, to Paris for urgent talks on Ukraine and European security. There are concerns that officials will push for increased military investment, as US peace proposals suggest a decline in US support for Ukraine. Furthermore, strengthening defence and aiding Ukraine could cost major European economies an additional $3.1 trillion over the next decade.

On the front of global central bank policies, the European Central Bank is expected to cut the deposit rate by 25 basis points in each of the next three meetings, reducing it from the current 2.75%. Eurozone forecasts increasingly point to a decline in prices to below 2% by 2026. While policymakers are more confident in achieving the 2% inflation target, Donald Trump's threats of tariffs are increasing economic uncertainty.

Will the euro rise in the www.xmbonus.coming days?

According to Forex market trading, the Euro is going through a period of stability after several months of selling against the dollar, but we expect a small setback to the recent recovery in the www.xmbonus.coming hours and days. The Euro has appreciated 1.57% against the US dollar last week, driven by hopes that the war in Eastern Europe will soon pave the way for peace. This week will be dominated by a busy geopolitical calendar that includes talks between the United States and Russia in Saudi Arabia and separate security talks between European leaders who seem unable to secure a seat at the negotiating table.

Therefore, progress will support the Euro's recovery, but there is reason for caution. The fact that the United States is going it alone without Europe or Ukraine suggests that the path to peace may be tense and fraught with setbacks.

Trading Tips:

Dear TradersUp follower, we still recommend selling the euro against the US dollar from every level of the rise without risk and activating profit and stop-loss orders to ensure the safety of the trading account from any sudden price reversals.

European stock markets witness gains

During yesterday's session and through stock trading www.xmbonus.companies' platforms, European stock market indices rose, with the Stoxx 50 and Stoxx 600 indices closing up by about 0.5% to surpass new record highs, driven by a rise in defence stocks amid expectations of increased defence spending by European governments. European leaders are meeting in Paris to discuss Russia's invasion of Ukraine and formulate a response after the United States indicated limits to its support for Ukraine. At the same time, negotiations between the United States and Russia on the Ukraine war are scheduled to begin this week in Saudi Arabia, although uncertainty remains about Ukraine's participation, and European countries have not been invited.

In addition, US President Trump reaffirmed plans to impose tariffs on foreign cars starting April 2. Among sectoral moves, defence stocks outperformed, with Rheinmetall shares jumping 14.5%, Leonardo shares rising 8.1%, and Saab shares rising by more than 16%. The automotive sector also rose, with Mercedes-Benz shares up 0.2% and BMW shares up 1.3%.

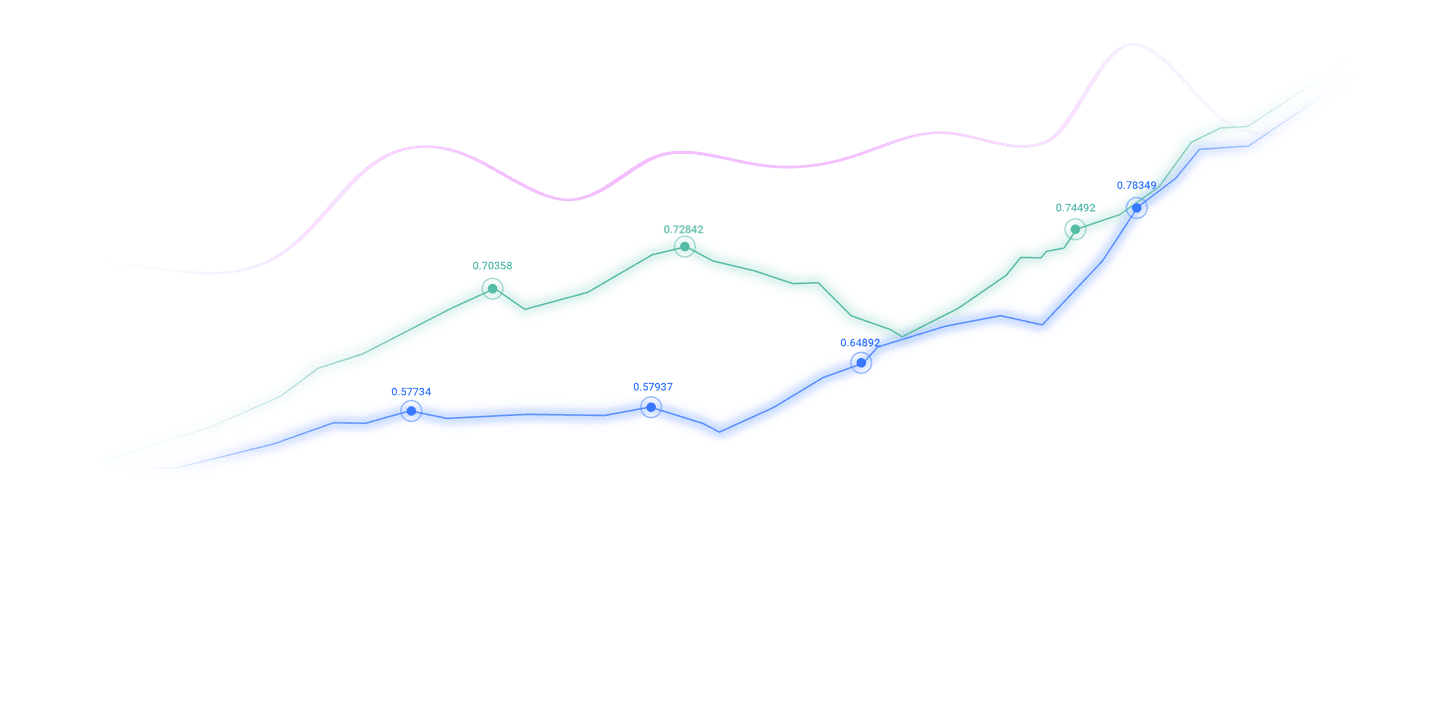

EUR/USD Technical Analysis Today:

Dear reader, according to the aforementioned factors putting pressure on the Euro against the US dollar, the daily chart shows that the level of 1.0490 is where a long-term support/resistance zone exists, which may tend to attract self-reinforcing market behaviour. In this case, we expect layers of market orders that will seek to sell the Euro/Dollar to profit from trading or enter a decline. Returning to trading during November and December, the same level provided support. Therefore, we are looking at what is a very important pivot. A break above this level opens the door to resistance at 1.06, but failure and a retreat to the psychological support of 1.03 is possible.

The EUR/USD pair is trading above the nine-day exponential moving average (EMA), which confirms that the near-term momentum is positive. But what is more important is that the spot price (1.0478) has deviated somewhat from the nine-day exponential moving average (1.0419). We like the 9-day EMA in thhttps://www.xmbonus.comis week's forecast toolkit because spot prices tend to hug it, and wide pergences almost always lead to average pergence. We are witnessing a decent pergence now, which makes a retreat towards 1.0419 a preferred possibility in the www.xmbonus.coming days.

The above content is all about "【XM Decision Analysis】--EUR/USD Analysis: Stability After Upward Attempts", which is carefully www.xmbonus.compiled and edited by XM Forex editor. I hope it will be helpful for your trading! Thank you for your support!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here

CATEGORIES

News

- 【XM Market Analysis】--EUR/USD Analysis: Price Completes Losses at the End of 202

- 【XM Forex】--AUD/USD Forecast: Aussie Dollar Battles Key Support

- 【XM Decision Analysis】--CAD/CHF Forecast: Can CAD/CHF Break Above 0.64?

- 【XM Decision Analysis】--BTC/USD Forex Signal: Bitcoin Breaks $107,000, How Much

- 【XM Market Review】--EUR/USD Forecast: Rallies in Relief Rally